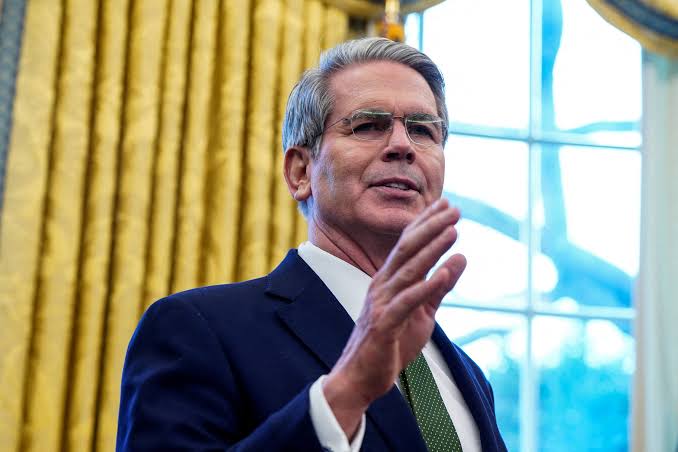

Treasury Secretary Scott Bessent has introduced a new strategy aimed at reducing historically high interest rates, independent of the Federal Reserve’s influence.

In two recent interviews, Bessent indicated that the Trump administration intends to concentrate on decreasing long-term interest rates, which are primarily affected by the yield on the 10-year US Treasury note. In contrast, the Federal Reserve’s actions have a more immediate impact on short-term interest rates, which dictate borrowing costs for consumers.

On his fourth day in office, President Donald Trump stated his intention to “demand that interest rates drop immediately,” claiming he possesses a deeper understanding of monetary policy than the Federal Reserve and its Chair, Jerome Powell. Although he has previously suggested that Powell should be dismissed, he has since moderated that stance.

Despite Trump’s ongoing criticism of the Federal Reserve, Bessent reassured Wall Street that the administration is not attempting to pressure the Fed but is instead pursuing its own distinct strategy.

Bessent stated during an interview with Fox Business on Wednesday that he is not advocating for the Federal Reserve to reduce interest rates. Instead, he emphasized that the Trump administration is concentrating on decreasing the 10-year Treasury yield. He remarked, “By deregulating the economy, finalizing the tax bill, and reducing energy costs, interest rates will naturally adjust, and the dollar will stabilize.”

On Thursday, in a discussion with Bloomberg TV, Bessent reiterated that “our focus is not on whether the Fed will implement a rate cut.”

This may provide some reassurance to Powell, as it suggests an acknowledgment that the administration plans to honor the central bank’s autonomy in making monetary policy decisions free from political pressure.

The Federal Reserve plays a crucial role in managing the interest rates that Americans encounter when borrowing, primarily through the buying and selling of government securities. Bessent’s approach of having the Treasury Department operate independently from the Fed is quite unconventional.

As Bessent pointed out in his Fox Business interview, when the Fed cut rates by an unusually large half-point in September, the 10-year yield should theoretically have fallen. However, it ended up moving higher. That remained the case even after the Fed cut rates twice more last year.

Since Trump took office, the 10-year yield has dropped a little. Bessent sees that as a reflection of traders recognizing that holding US government debt is less risky if federal spending is cut.

White House Press Secretary Karoline Leavitt said last week the administration is forging ahead with its plans to “end the egregious waste of federal funding,” which is being partly facilitated through the so-called Department of Government Efficiency, led by Tesla CEO Elon Musk.

The Trump administration has said it is focused on boosting economic growth through “expansionary” policies. Its plan to gut government agencies and reduce spending could enable that growth to not be inflationary, positively impacting Treasuries.