India Bets on Aviation Boom Amidst Growing Headwinds

Prime Minister Narendra Modi’s presence at a global airlines conference this week underscores India’s strong bet on an aviation boom to fuel broader development goals, but significant challenges are emerging.

Despite global aviation sector uncertainty due to trade tensions and wavering consumer confidence, India’s largest airlines are moving forward with new plane orders, building on record deals from two years ago.

However, industry officials at the International Air Transport Association’s annual meeting warned that rapid growth could stall if plane shortages, infrastructure limitations, and taxation issues are not addressed.

Tensions with Pakistan are also forcing Indian airlines to take longer, more expensive routes around Pakistani airspace, increasing fuel consumption and passenger care costs.

Carriers have requested fee waivers and tax exemptions from the Indian government, sources told Reuters, but it remains unclear whether assistance will be provided, despite the government’s ambitious rhetoric.

New Delhi aims to transform India into a job-creating global aviation hub similar to Dubai, which currently handles much of India’s international traffic.

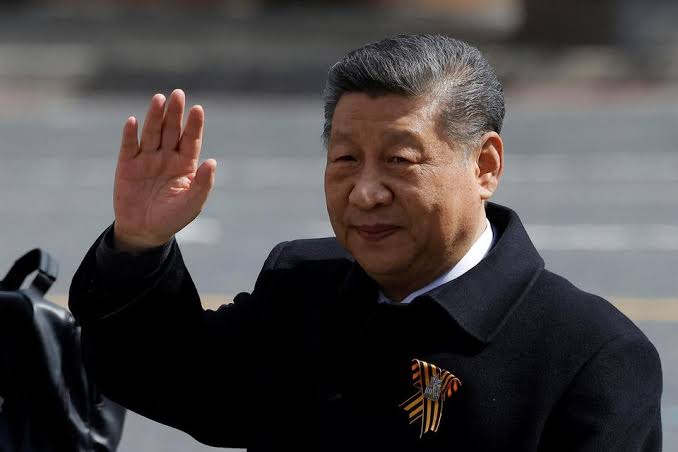

“In the coming years, the aviation sector is expected to be at the center of massive transformation and innovation, and India is ready to embrace these possibilities,” Modi told aviation leaders on Monday.

However, this transformation will require billions of dollars in airport and industry supply chain investments, as well as regulatory reforms.

Forecasts are promising.

IATA projects that passenger traffic in India will triple over the next 20 years, and the country aims to increase the number of airports to as many as 400 by 2047, up from 157 in 2024.

“We are fast emerging as a strategic connector country … India is a natural connector of the skies and aviation as well,” India’s Civil Aviation minister Ram Mohan Naidu told global airline CEOs in New Delhi.

Already the world’s third-largest aviation market by seats after the U.S. and China, India has significant growth potential.

Despite being the world’s most populous nation, accounting for around 17.8% of people, India represents only 4.2% of global air passengers, according to IATA.

A record 174 million Indian domestic and international passengers flew in 2024, compared to 730 million in China, IATA data shows.

“The outlook is potentially a very positive one for both the Indian economy and air transport industry. However, such outcomes are not guaranteed,” IATA said in a report on the Indian market.

Read more: India, UAE in Sri Lanka Energy Deal

Industry executives and analysts emphasized the need for further work in scaling aviation-related infrastructure, updating regulations, lowering taxes, and streamlining operations for airlines.

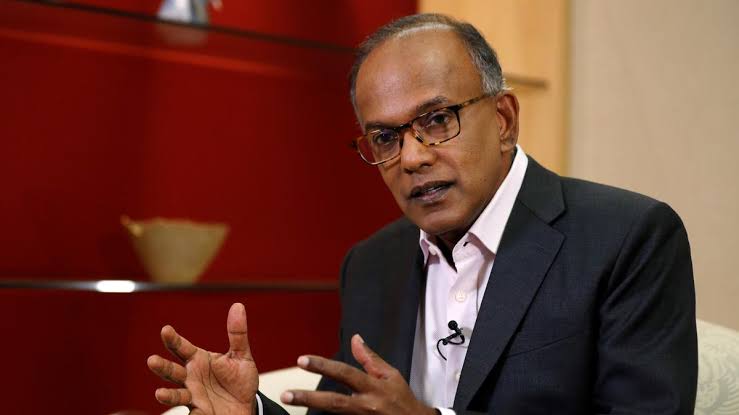

“Even the regulators will agree that they need to update their regulation, because there is a reason why India is not punching above its weight. In fact, it is punching very much below its weight,” said Association of Asia Pacific Airlines Director General Subhas Menon.

Dubai-based Emirates, for example, argues that capacity restrictions on foreign airlines need to be relaxed to unlock the industry’s full growth potential.

“For every seat we offer, particularly in the peaks, we’ve got three to 10 people trying to get it,” Emirates President Tim Clark told reporters.

Among other challenges, India lacks sufficient domestic maintenance, repair, and overhaul facilities to service its fleet, making it heavily reliant on foreign shops amid intense competition for repair slots, especially for engines.

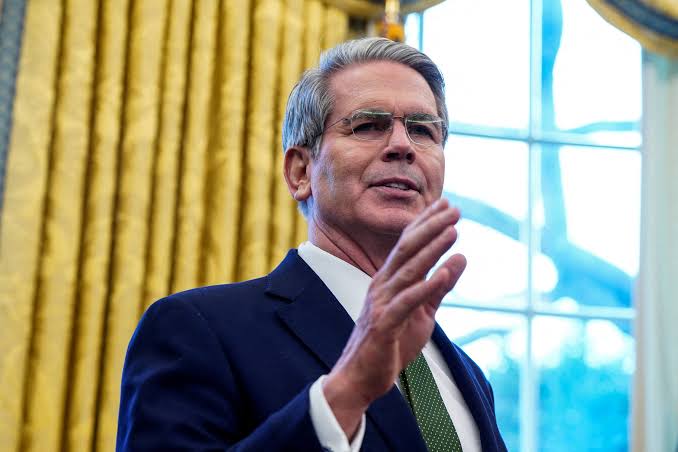

Global airlines are experiencing aircraft groundings due to a shortage of servicing facilities, according to IATA Director General Willie Walsh.

“I think airframe maintenance is a huge opportunity for India because you require labor and you require skills. And that’s something that I know India is investing in,” Walsh said, responding to a Reuters question at a press conference.

Airline growth globally is being slowed by prolonged delays in the delivery of new, more fuel-efficient planes due to supply chain issues.

India’s largest airline, IndiGo, has been leasing aircraft to expand internationally while awaiting new planes. This week, it partnered with Air France-KLM, Virgin Atlantic, and Delta to extend the reach of IndiGo tickets using those airlines’ networks.

English

English